U.S. RFI Signals Growing Deficit of Natural Flake Graphite

|

|

|

|

PERSPECTIVES No.11 | July 2025

In late May, the U.S. Department of Defense issued a Request for Information (RFI) to Western graphite producers able to supply up to 48,000 tonnes of natural flake graphite by 2032.

The notice sparked little or no public attention, but perhaps it should have.

Let’s be clear: this RFI was much more than just a routine call for information. Rather, it was forewarning that high-quality, large-flake natural graphite – the kind used in defence, electronics and industrial applications – has quietly become scarce, even as battery-grade graphite floods the market.

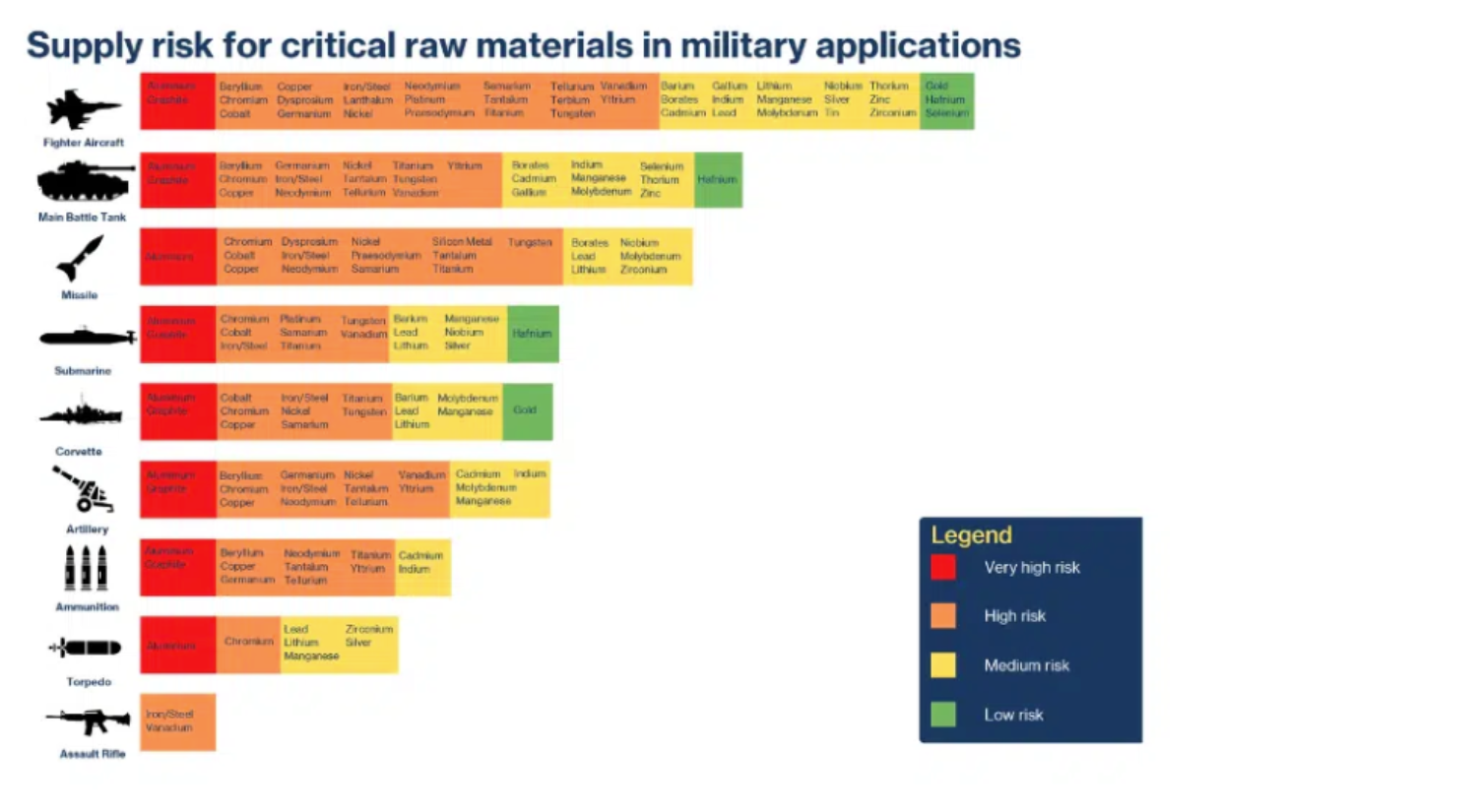

Source: Strategic raw materials for defence Mapping European industry needs Benedetta Girardi, Irina Patrahau, Giovanni Cisco and Michel Rademaker The Hague Center for Strategic Studies, January 2023

Synthetic substitutes simply won’t do

Many industrial and military applications rely on the unique thermal and

electrical properties of natural flake graphite.

Reshaping Markets

The graphite market has been turned on its head as geopolitics reshape supply and demand. On the one hand, Western nations are rushing to play catch-up in the global critical minerals race by establishing local supply chains that can compete with an industry that China has built patiently over decades. On the other, China is protecting its dominance by controlling markets at home and abroad, putting itself in the role of both supplier and disruptor.

From the supply side, Chinese producers have flooded global markets with low-cost, graphite Active Anode Material (AAM), undercutting Western efforts to build a sustainable graphite supply chain. The resulting pricing collapse has made it nearly impossible for producers outside of China to compete. On the back of trade complaints from the American Active Anode Material Producers (AAAMP) association, the U.S. Department of Commerce in recent weeks found that China is dumping graphite AAM into the U.S. market and subsidizing its production.

In pursuing its dominance over the downstream processed AAM graphite market, China has created such oversupply that even its own producers have had to shutter many of its natural graphite mines amid bulging inventories. But that has had an unforeseen consequence: while the world is flooded with cheap, processed graphite from China, the raw material needed to support that supply — large-flake graphite concentrate — has quietly become harder to find. Industrial-grade graphite, critical to steelmaking, electronics, and the kind being sought by the U.S. Department of Defense, is now caught in a growing crunch that has received far less attention than the more headline-grabbing battery segment.

New export controls imposed by the Chinese government that require special licenses to ship flake graphite abroad, are further exacerbating that supply squeeze, especially considering that approvals can be unpredictable and slow to obtain, adding further uncertainty and delay for Western buyers.

The global graphite market is in paradox:

A glut of battery-ready graphite AAM,

and a sudden scarcity of high-quality, industrial-grade graphite

Squeezing Western Industry

The global graphite market is in paradox: a glut of battery-ready graphite AAM, and a sudden scarcity of high-quality, industrial-grade graphite. It’s the kind of twist that could only come in a nascent market, where producers outside China are squeezed by volatile pricing on one end and tightening feedstock supply on the other. The ripple effects are real and growing. As steelmakers, automakers, and defence contractors begin to feel the crunch, graphite’s transformation from low-profile industrial mineral to geopolitical flashpoint is becoming impossible to ignore.

We see evidence of the shift in our own business, where Northern is a key supplier to U.S. industrial markets that represent approximately 85 percent of our sales. We hold an estimated 20 percent share of the U.S. industrial graphite market and have expanded market share in other geographies amid limited supply from China and elsewhere. Even as demand grows for industrial uses like the refractory sector – where large and jumbo flake graphite is critical to the manufacture of crucibles, casting molds, and blast furnace linings – larger flake sizes are becoming increasingly scarce after China and others focused production on anode material markets, and operational challenges at Western producers further stressed global graphite supply chains.

Industrial demand for graphite from our Lac des Iles mine – the only producing flake graphite mine in North America – has been strong all year, even after we implemented price increases in January and sold our graphite at record-high average prices in the first quarter.

Northern is the only producer of natural graphite in all of North America

That will not change for at least another two or three years

as other miners come into production

RFI Warning

Northern is the only producer of natural graphite in all of North America and that will not change for at least another two or three years as other miners come into production; new capacity takes years of planning, permitting, and capital investment and today’s prices, artificially depressed by Chinese oversupply in the battery segment, do not support the economics of new projects.

Further exacerbating the situation is the reality that, unlike in batteries, many industrial and military applications rely on the unique thermal and electrical properties of natural flake graphite. For these sectors, synthetic substitutes simply won’t do.

At the same time, demand for natural graphite for non-battery applications is rising steadily, according to industry forecasts, with demand growth expected to be fueled in part by an increase in global spending on defence, where graphite has extensive uses, according to NATO, including in the production of main battle tanks due to its high strength and thermal stability, and in submarines, where it is used in the construction of hulls and other structural components. In a report in December, NATO warned that availability and secure supply of critical minerals are vital to maintaining its technological edge and operational readiness.

In Europe, natural graphite is already listed as a strategic raw material under the EU’s Critical Raw Materials Act (CRMA), which includes proposals for joint purchasing, public procurement tools, and potential stockpiling. In Canada, the federal government is also exploring strategic stockpile options as part of its Critical Minerals Strategy, which identifies graphite as a top priority.

The U.S. Department of Defense’s RFI was a warning. It signalled that the world is waking up to a supply gap with serious strategic implications. But recognition is only the first step. What we need now is action — strategic investments, supportive policy frameworks, and clear market signals that allow companies like ours to expand and diversify supply.

Hugues Jacquemin

Chief Executive Officer, Northern Graphite

Hugues Jacquemin is the CEO of Northern Graphite and has more than 30 years senior management experience growing Specialty Materials businesses for listed Fortune 500 & Private Equity firms.

Perspectives is researched, written and produced by Northern Graphite.